A Practical Guide to Real Estate Investment Trusts (REITs)

The popularity of Real Estate Investment Trusts (REITs) is on the rise globally and Ghana is no exception. This is driven by investors’ need for a more financially flexible way to invest in various segments of the real estate market. In Ghana, investors are also turning to REITs instead of traditional investment products following an unprecedented sovereign debt default which has had ripple effects throughout society. The National Pensions Regulatory Authority (NPRA) for instance now considers REITs as a permissible investment for pension funds, according to its Guidelines on Investment of Pension Scheme Funds.

This article explains how REITs work, explores the benefits and risks of investing in REITs; and highlights how REITs are regulated, particularly in Ghana.

How REITs work

A REIT is a public company that invests in real estate assets to generate recurrent income (rental and interest) from operating, owning, or financing income-producing real estate and real estate-related investments.

REITs invest directly in diverse real estate assets such as residential properties, warehouses, shopping malls, and more. These assets are professionally managed, and revenues—primarily rental income— are distributed at regular intervals as dividends to shareholders (REIT holders). In simple terms, when you invest in a REIT, your money is pooled together with that of other investors in a collective investment scheme that invests in a portfolio of real estate assets to generate income. Some REITS do not directly own or operate real estate assets. Rather, they invest in real estate-related securities. For instance, some mortgage-giving banks, in a bid to reduce their liquidity challenges, often bundle together a bunch of mortgages and sell them as bonds which REITs invest in and distribute their returns to shareholders as dividends. You can invest in REITs the same way you would invest in stocks— through a broker.

The key structures of REITs

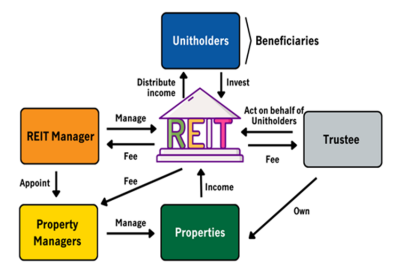

The Securities Industry (REITS) Guidelines, 2019 (the “Guidelines”) SEC/GUI/001/01/2019 issued by the Securities and Exchange Commission (the “SEC”) require that every REIT must have a Custodian (a trustee). The Custodian is a licensed bank or a trustee company, or a subsidiary of a bank which holds the assets of the REIT on behalf of the REIT holders/ beneficiaries . As a fiduciary, the Custodian must act solely in the interest of the REIT holders and is responsible for, inter alia, supervising the activities of the REIT Manager. A Custodian is required to meet certain minimum unimpaired paid-up capital requirements, currently pegged at GHS 50,000,000 by the SEC.

The Guidelines also require a REIT to have a Manager. The Manager is a company incorporated in Ghana that is independently audited and has personnel with the experience and skill set to manage the REIT. The REIT Manager is responsible for the acquisition, management, and disposal of the assets of the REIT. As a fiduciary, the Manager is also required to exercise due diligence in investing the assets of the REIT and must act solely in the interest of REIT holders. The Manager is also required to meet certain minimum capital requirements to be determined by the SEC.

A diagram on the structure of REITs. Credit: Tam Ging Wien

The Benefits of Investing in REITs

Benefits of investing in REITs include:

- Diversification: The risk arising from investing in one property is diluted when you invest in a pool of properties through a REIT.

- Affordability: As an individual investor, you may not be able to afford a direct investment in a large asset such as office buildings or shopping malls. By investing in a REIT, you can invest in these large assets in bite-size chunks.

- Liquidity: It is easier to buy and sell units in a REIT than to buy and sell properties. REITs are required to list on the stock exchange. This makes it easier for an investor to trade units in a REIT throughout the trading day.

- Transparency and Flexibility: You can access information on REIT prices and trade units in a REIT throughout the trading day on the stock exchange. Investors can also gain transparency in the management of assets because as fiduciaries, both the Manager and the Custodian have a duty to account to shareholders.

The Risks of Investing in REITs

Like all investment options, REITs equally have risks. The key risks are summarized below:

- Market Risk: REITs are traded on the stock exchange and the prices are subject to demand and supply conditions. The prices generally reflect investor confidence in the economy, interest rates, the property market, etc.

- Liquidity/Income Risk: Distributions (dividends) are not guaranteed and are subject to fluctuations in the REIT’s income. A REIT’s rental income may be affected if the occupancy rate falls.

- Concentration Risk: If a substantial portion of the REIT’s value is from one or a few properties, REIT holders face a greater risk of loss should something happen to any of the properties.

How REITS are regulated

In Ghana, REITs are regulated by the SEC. Given the general lack of knowledge and understanding of financial products and markets by the investing public (consumers), the SEC’s primary role as a regulator is that of a “consumer protection agency”; to protect the unsophisticated investor from market exploitation. In doing so, the SEC, amongst others, demands of public companies (sellers) to make honest and comprehensive disclosures (prospectus et al) to investors (purchasers) at the time of issuing securities or suffer penalties for false disclosure. The very nature of securities makes it difficult for investors to reasonably examine their financial soundness. In the words of American securities lawyer, Alan B. Levenson, “…a security is quite unlike a melon, an automobile, or other tangible consumer goods which can be immediately tested and quality controlled. The investor qua consumer cannot judge a security by the paper upon which his interest is evidenced—he must look to and rely upon material disclosure information regarding the issuer of the security.”

To regulate the licensing and activities of REITs, the SEC issued the Guidelines. By the terms of the Guidelines, an applicant for a REIT licence must be a a public company or an external company with a place of business in Ghana and must have the financial and technical ability to carry on the business of a REIT competently. The SEC also investigates whether the directors of the company have previously taken part in any fraudulent business practices or contravened any relevant laws protecting investors against financial loss. In addition to having a custodian and a REIT Manager which are independent of each other and licensed by the SEC, the Guidelines require that the REIT must meet certain minimum capital requirements to be determined by the SEC.

Further, the registered constitution of the REIT must contain provisions that expressly indicate, amongst others, that the company shall derive at least seventy-five (75%) of its revenue from rents, mortgage interest and investment income from indirect property ownership. The registered constitution must also indicate that at least seventy-five (75%) of the REIT’s total assets shall comprise of real estate; that it shall distribute at least 80% of its distributable profit to shareholders; that the REIT shall list on the stock exchange within 3 years of operation; and that it shall not invest more than 40% of its capital in a single property. All these requirements are aimed at protecting the investor (consumer) from market exploitation or financial loss.

Conclusion

As shown in this article, REITs offer a more financially flexible way for individual investors to invest in various segments of the real estate market. However, it is important for investors to consult a stockbroker, a banker, a lawyer, or another investment professional for appropriate advice before making an investment decision.

The writer is a lawyer.

Email: nickknust@gmail.com